Welcome to Canonicals

Join Predictathon the prediction tournamentsCompete with WATNp play money in live markets and prove your predictive prowess.

Precision Prediction

Spot the signal, set your forecast, and target the market that fits your conviction.

Confident Staking

Stake from one deposit, set per-expiry allowances, and adjust stake or cancel before forecasting closes.

Win With Clarity

Hit your target by expiry and get rewarded for your conviction.

Open Markets, Fair Competition

Join a global community of market creators and forecasters

Everyone can predict and earn based on their accuracy—compete on precise prices, economic indicators, technical indicators, weather, and any measurable real-world metric.

Anyone can also launch a market on topics they care about and earn fees from their markets.

What Makes Canonicals Different

Beyond Binary: The Precision Revolution

Predict Exact Values

Go beyond YES/NO. Forecast precise prices, economic indicators, technical indicators, weather, and any measurable real-world metric.

Rewards Scale with Accuracy

The closer your prediction is to reality, the greater your reward. Our precision engine ranks and pays out based on true accuracy.

Built on Mathematical Rigor

Advanced statistical models (normal and lognormal distributions) fairly distribute rewards based on accuracy, timing, and stake.

Time Matters

Early, confident forecasts earn more via time-decay. The longer your prediction stands before resolution, the higher the upside.

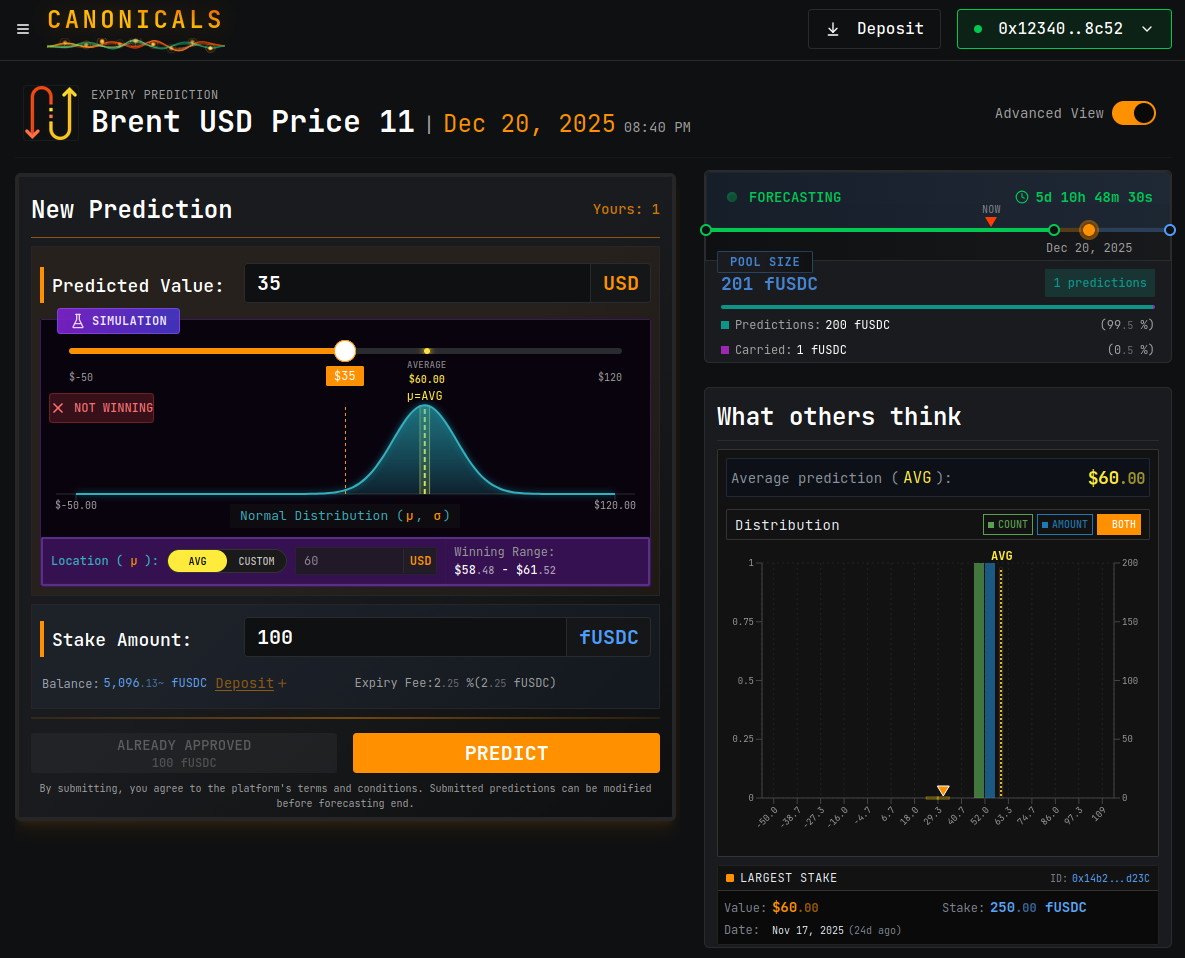

Try the Simulator

See How Canonicals Works

The bell curve shows the probability of different Bitcoin prices at expiry date.

The peak represents the most likely price, while the edges show less probable outcomes.

This market uses lognormal distribution (for positive-only metrics or assets like Bitcoin that change by percentages). Canonicals also supports normal distribution for metrics that can have negative values (temperatures, profit/loss, interest rates).

Learn More in Documentation →Adjust your forecast and stake; both feed the expiry result simulation.

Your potential reward depends on: pool size • number of winners • prediction accuracy • prediction timing • stake amount

How Canonicals Works

Two roles, From creation to rewards

Set parameters:

Volatility, distribution type, token, fees...

One market can have many expiries (prediction rounds). Each expiry has its own end date and settings.

Forecasters browse available markets, select an active expiry and make Prediction.

• Value posted on-chain (tamper-proof)

• Smart contract calculates winners automatically

• Based on accuracy + timing + stake

• Market owner earns fees

• Added to next created expiry

• Bigger rewards next round

Forecasters predict again

The cycle never stops.

Deployed on Autonity

Canonicals is live on Autonity

Autonity is a public, EVM-based, proof-of-stake blockchain for decentralized clearing of smart derivatives contracts—driven by a community passionate about the social benefits of monetary and market structure innovation.

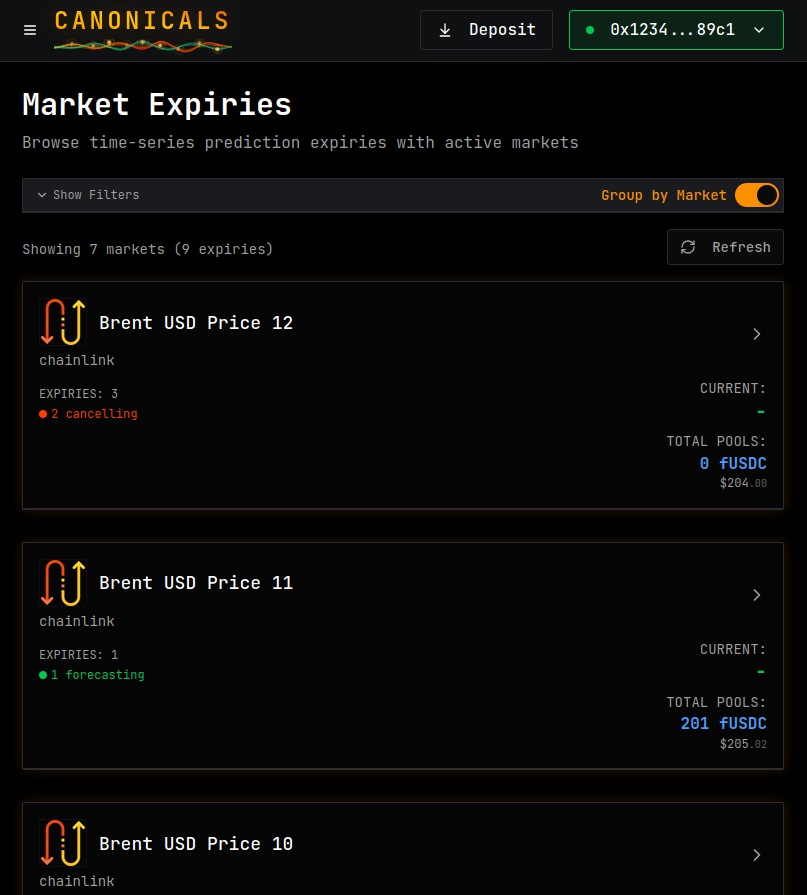

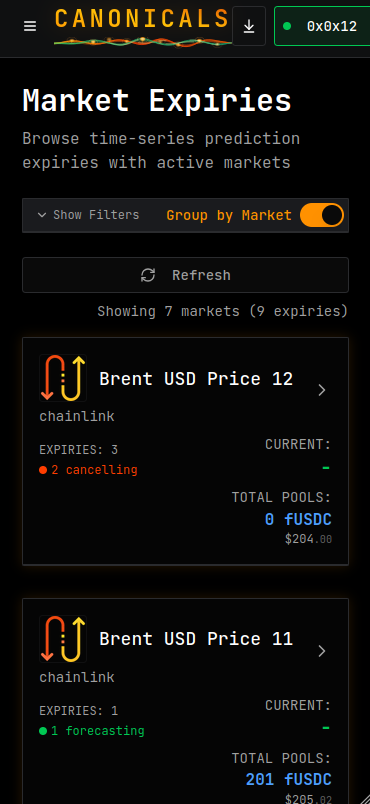

See It In Action

Experience Canonicals across all your devices

Subscriptions support Web3Auth or external wallets.

Sign in with Google/Apple/WeChat and sign a wallet message (no gas) to confirm participation.